Dear First Mates,

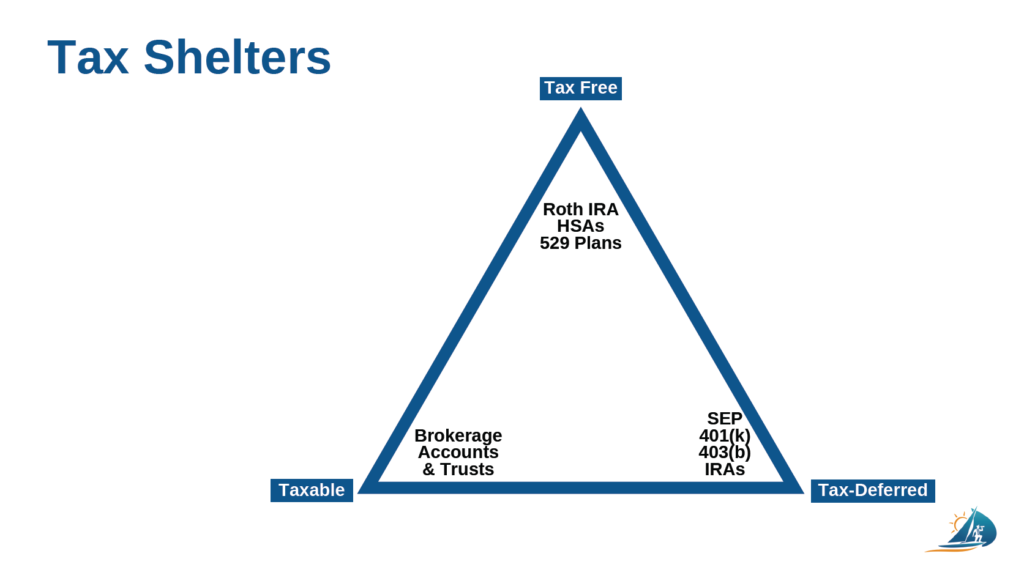

Tax season is upon us. But have no fear; your captain is here. Before we begin, be sure to check out these handy tax reference guides for 2020 and 2021, as well as key dates for 2021. You can expect a tax reference guide, just like these, each year from me. I can think of no better time than tax season to discuss some tax strategies to earn the trifecta of tax benefits: lower your taxes legally, save for future goals, and invest your money so it grows! This newsletter will discuss different account types that serve as phenomenal tax shelters for retirement, education, health care, and even charity!

If you follow the rules, tax-preferred savings vehicles, like the ones discussed below, can provide up to three different tax benefits:

- Lowing your taxable income at the time of your contribution

- Growing your money in a tax-deferred investment and

- Receiving distributions as income tax-free.

Healthcare

Health Savings Accounts: Health Savings Accounts (HSAs) are for individuals covered under high-deductible health plans (HDHPs) to save for qualified medical expenses. For 2020, an individual can contribute up to $3,550 (family coverage up to $7,100). For those 55 and older, there is an additional $1,000 per year. This additional permitted contribution is referred to as a “catch-up.” Contributions can be made by the tax filing deadline, which is generally April 15th of the following year. The tax benefits offered by an HSA include items 1, 2, and 3 above. For 2021, HSA contributions can be made until May 17th due to the recent tax return extension.

Charity

Donor-Advised Fund: The Donor-Advised Fund is a private fund created to manage charitable donations on behalf of individuals, families, or organizations. A beneficial feature of this account is that an individual can receive the tax deduction in the current year but donate to the charity in a future year. The deadline for making these contributions is year-end. Tax benefits received include items 1, 2, and 3 for individuals who are itemizing deductions. A great strategy is bunching your charitable giving, allowing you to condense several years’ worth of giving into one tax year to gain the maximum tax benefits available.

Education

529 Savings Plan: A 529 plan is a savings plan designed to help pay for education costs (K-12, post-secondary, and apprenticeship programs). For starters, anyone can open and fund a 529 savings plan – the student, parents, grandparents, friends, and even relatives! The contribution limits for 529 plans are generally high – ranging from $200,000 or more, depending on the state. The deadline for making these contributions is year-end. Tax benefits received include items 2 and 3 and a state tax deduction for contributions in certain states. Quite powerful, indeed!

Retirement

Traditional IRA: A Traditional IRA (individual retirement account) allows individuals to contribute pre-tax dollars for retirement, where investments grow tax-deferred until withdrawal during retirement. To check your eligibility, check out this handy flowchart as this vehicle has some hurdles. The contribution amount is $6,000 per year per person in 2020 ($7,000 for those age 50 or older). A Traditional IRA can be established at any time. However, contributions for a tax year must be made by the tax-filing deadline (generally April 15th of the following year). Tax benefits received include items 1 and 2.

401(k) Plan: This is a popular defined-contribution retirement plan offered by many employers to their employees. It is named after a section of the U.S. Internal Revenue Code. As of 2020, the basic limits on employee contributions are $19,500 per year ($26,000 for those age 50 or older). Employers may match their employee contributions. This match is essentially free money from the employer, making this vehicle very beneficial. Contributing at least enough money to get the full employer match is advisable. Contributions to a 401(k) are generally due by the end of the calendar year. Tax benefits received include items 1 and 2. Please see the “summary plan description” of your employer’s 401(k) plan to learn more. There are many other retirement plan account types that function similarly to 401(k) plans, including 403(b), 457(b), SEP IRA, Simple IRA, and solo 401(k) plans. Ta

Some of you may rightfully wonder: “Wait, I get a deduction upfront with the Traditional IRA and 401(k), but then still pay taxes later. If I still have to pay later, what’s the point?”

The answer is twofold:

1) Many people will find themselves in a lower tax bracket in retirement because they are not working. So, if you are in a 32% tax bracket while working but a 12% bracket in retirement, you keep the 20% difference when taking retirement distributions at that lower rate.

2) Allowing your funds to grow tax-deferred is an extremely powerful strategy because it allows more cash to be invested in the present and grow into a larger sum in the future. You can see the difference this makes with this calculator. This topic alone deserves its own newsletter!

A Roth IRA is a special individual retirement account established by the Taxpayer Relief Act of 1997 and named for Delaware Senator William Roth, its chief legislative sponsor. It allows qualified withdrawals tax-free, provided certain conditions are satisfied. The contribution amount is $6,000 per year per person in 2020 ($7,000 for those aged 50 or older). Anyone can contribute the full amount to a Roth IRA if they make less than $124,000 (single filers). For married couples, the limit is $196,000.

While a Roth IRA can be established anytime, contributions for a tax year must be made by the tax-filing deadline (generally April 15th of the following year). Tax-filing extensions do not apply. Tax benefits received include items 2 and 3. For 2021, IRA & Roth IRA contributions can be made until May 17th due to the recent tax-return extension. The limit for IRA contributions (Roth & Traditional) cannot exceed $6,000 or $7,000 if you are aged 50 or older. Tax filing extensions do not apply.

Roth 401(k): These plans serve as a unique hybrid retirement savings vehicle that combines many of the best features of traditional 401(k) plans and Roth IRAs. This type of investment account is well-suited for people who think they will be in a higher tax bracket in retirement than they are now because withdrawals are tax-free. Tax benefits received include items 2 and 3. Please see the “summary plan description” of your employer’s plan to learn more.

Defined-Benefit Plan (a.k.a. pension plan): These employer-sponsored retirement plans allow eligible employees to take their retirement benefit as a lifetime annuity (lifetime monthly payments) or as a lump sum at an age defined by the plan’s rules. It is called a Defined-Benefit Plan since everyone knows the benefit formula ahead of time – typically based on the length of employment and salary history. These plans help self-employed individuals supercharge their retirement as a 401(k) complement. General tax benefits received include items 1 and 2, but can vary based on the plan.

While the rules vary depending on the plan, if you withdraw money from a retirement plan before age 59.5, you are usually subject to an early withdrawal penalty of 10% and income taxes owed on the distribution. The nice thing about the Roth IRA is that whatever you put in can be income tax-free and penalty-free. Nevertheless, be sure you can afford to leave money placed in retirement accounts alone for the long haul!

Future Funds

Taxable Accounts: Taxable accounts (e.g. bank and brokerage accounts) don’t have any tax benefits but do offer fewer restrictions than the tax-advantaged accounts mentioned above. Unlike an IRA or a 401(k), an individual can withdraw money at any time, for any reason, with no tax or penalty. The only tax advantage received here is if they hold the investment in the account for at least a year, then they will pay the more favorable long-term capital gains rate.

In conclusion, many tax savings vehicles are worth funding for 2020 and 2021. Depending on your goals, one may be better than another. Which one should you contribute to for retirement? The general rule is to use traditional structures to lower taxes today and Roth structures to lower taxes in the future. Check out this handy flowchart to help aid your decision. As seen in the image below, I prefer using different vehicles to diversify from a tax perspective. Please do not take action on any of these items without speaking to your CPA or accountant first and foremost! See you next month, my friends!

Dave’s Picks

Outta Your Mind (Hip Hop) – Alex and Twitch (All Star)

Musiq – Just Friends (Sunny) (Official Video)

Hereditary (2018) KILL COUNT