“We must never sacrifice net fulfillment for net worth!”

“Research in psychology backs me up: People who spend money on time-saving purchases experience greater life satisfaction, regardless of their income.” – Bill Perkins

Dear First Mates,

Hello everyone! This month’s newsletter was inspired by a podcast featuring Bill Perkins – a successful hedge fund manager and entrepreneur. You’d think most people would come to my office and say, “Dave – I’ve worked hard my whole life, so my goal now is to have $1 remaining when I reach the pearly gates.” Sadly, this is the furthest thing from reality as it becomes hard for people to enjoy their wealth. Therefore, my message to you all this month is to SPEND YOUR MONEY!

But why is making that switch so difficult? I find that it is hard psychologically to go from saver to spender. After all, people save for many years, and it becomes a hard habit to break upon retiring. Another reason is that the mere notion of having earned income provides a mental security blanket. But let’s dig deeper and address some other powerful reasons people fall into this trap.

Reason 1: I want to leave my money to my heirs or favorite charity.

The heart of financial planning is understanding how your money should serve you, your values, and what brings you joy. If leaving money to others is the ultimate goal, I think that is beautiful. That said, I’m also of the mindset that it is much better to give with warm hands rather than cold ones.

Reason 2: Looking at my large balances gives me a sense of safety and security.

Seeing large portfolio balances can undoubtedly reinforce these emotions and even bring more happiness. That said, I have never been to a funeral where the speech-giver announced, “Here lies INSERT NAME. They truly won the game called life. Their ending IRA balance was $753,000, and they never spent a penny!

Reason 3: I’m worried that I will need the money to cover future healthcare bills.

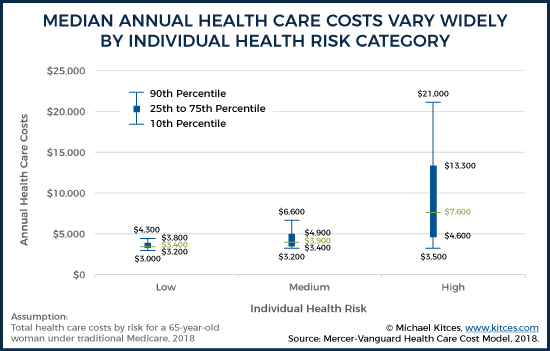

When looking at the facts, healthcare costs can be wholly manageable in retirement. The median healthcare cost is anywhere from $3,400/year for low-risk individuals to $7,600/year for high-risk individuals. In fact, the research suggests that retirees should expect to decrease total retirement spending anywhere from 10% to 30% on an inflation-adjusted basis as they age! This basically means that people’s expenses are going down in retirement on net even after accounting for rising medical costs.

Reason 4: I’m frugal. It’s just the way I am.

Our life experiences shape how we view, think about, and treat money. For starters, try to understand your own money story. If being frugal makes you happy, go for it. If, however, there is a psychological barrier holding you back, then I’d consider seeking financial therapy with a qualified professional to break that spell.

Reason 5: I’d like to spend more, but I’m so scared of running out of money.

This is a subject that warrants its own newsletter. The general rule of thumb is known as the 4% rule, which states you can withdraw 4% of your portfolio each year to cover a 30-year retirement. For example, if your nest egg is worth $500,000, you can withdraw $20,000 annually (inflation-adjusted).

Reason 6: I’m still working. does this idea apply to me?

It sure does! Prudent financial planning entails a) maintaining a budget and b) saving around 10% to 20% of your gross income for future you. With that said, I also strongly believe you must live your best life today. Some won’t have a long retirement to enjoy. Some have more pressing financial needs today. Some won’t retire because they love what they do. Therefore, the name of the game is balance. And it is important we never go too far in one direction or another (being a super spender vs. super saver).

The Bottom Line:

Retirement is the transition to a new beginning- not the goal. You are not retiring “from” but rather retiring “to”! I want you to look back twenty-five years from now and say, “Wow! This retirement was everything I ever wanted and more. I did what I wanted, when I wanted, with who I wanted.” The key question is: What would that look like for you?

I, your trusted captain, encourage you to spend and enjoy your retirement money. Of course, this advice only applies alongside prudent income planning that is updated annually. We must never sacrifice net fulfillment for net worth! Plan that family vacation. Buy that dream home. Purchase that beautiful car. Do the things you love to do. Fill the “bank” with memory dividends from experiences you share with loved ones. Retirement is sacrificing the reality of today for an imaginary tomorrow. That time is now. Enjoy it!

Dave’s Picks

Die with Zero video

SO YOU THINK YOU CAN DANCE – DAVE WARSHAW

Lauv – Breathe (Piano Version) | Mahogany Session