Dear First Mates,

Hello everyone! This is your captain speaking. Today, I’d like to tackle the hotly debated topic of renting vs. owning a home.

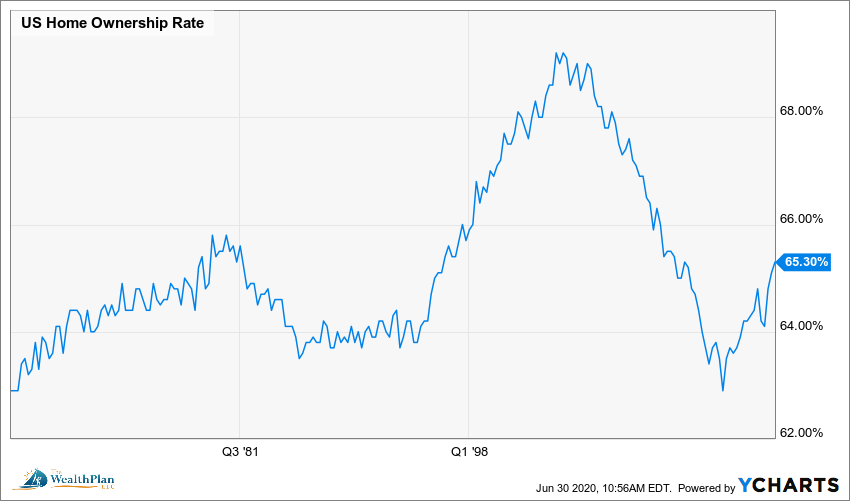

I don’t view a home as a financial asset but rather as a unique liability with many advantages. An asset puts money INTO your pocket every month. A home is a liability because it takes money OUT of your pocket every month. A home is a consumption item as we all need a place to live. You have four choices in living: own your home, pay rent to a landlord, be homeless, or live with someone rent-free (e.g., parents). Interestingly, the US Home Ownership Rate peaked in Q4 of 2004 and has been struggling to achieve those heights again. Maybe it is because people realize that the “American Dream” is more nuanced.

There are numerous factors to consider before making a decision about renting or owning a home.

Renting Advantages

- Mobility. Renting provides more flexibility should you need to relocate. It also allows you to shop around different communities until you find your favorite destination. Who is going with me to Hawaii?

- Liquidity. Home equity is not a liquid asset. Your bank will need to let you access it through some form of home equity solution over which you are not in control.

- Opportunity Cost. Renting allows you to invest the money earmarked for the down payment (typically 20% of the purchase price).

- Home Equity. This is a poor investment with zero return since your home will appreciate or depreciate, irrespective of how much equity you have in the house. In short, houses make terrible “banks.”

- Sunk Cost. Renters bear almost none of these housing costs: mortgage interest, loan closing, insurance, home maintenance, repairs, and property taxes.

- Personal cash flow. Since it costs substantially more to own than rent, homeowners can find themselves “House Poor,” which can stifle their opportunity to travel, invest, and start a business.

- Natural disasters. Homeowners have to worry a bit more about earthquakes, hurricanes, and floods alongside the costs of insuring against them.

Owning Advantages

- Home Equity Buildup. Equity is the difference between what your home is worth and how much you owe on a mortgage. Homeowners build equity while renters don’t. Equity is like a forced savings plan.

- Control. Homeowners can do as they wish to their own private property. Make it yours.

- Hassle. You don’t have to constantly move and renegotiate with a landlord yearly.

- Appreciation. Renters don’t experience price appreciation and have to weather rent price increases.

- Credit advantages. Owning rather than renting can help your credit by giving you higher credit card limits and more favorable insurance rates.

- Leverage. Homeowners with mortgage loans benefit from financial leverage, which can amplify wealth in an appreciating environment.

- Tax Advantages. The government subsidizes home ownership through the mortgage interest deduction, but renters don’t receive this benefit.

- Community formation. Owning a home provides you and your neighbors a sense of “belonging.” Community is a powerful thing.

- Low mortgage rates. We are experiencing historically low interest rates, which homeowners can use to lock in this “cheap money.”

Real estate decisions are made at the local level. If you want to live in an expensive city, home ownership may be financially out of reach. Your choice became much easier. Finally, don’t confuse the “house” with your “home.” The “home” is your castle, where you raise your family and where memories are built. Let’s combine reason with emotion to make a decision.

Hopefully, this newsletter has deepened your understanding of this important topic. Unfortunately, renting has a stigma. But live your life for you—and not for anyone else.

Dave’s Picks

WealthPlan Rent vs. Own

Italian/Brooklyn man asks me out

Kiesza – Hideaway