Last month, we explored the fundamental principles that guide our investment decisions. Now, let’s examine how these principles translate into practical actions that can help secure your financial future. Think of this implementation process as building a house – we need a strong foundation and carefully planned construction to create something that lasts.

Our implementation strategy rests on five interconnected elements that work together to create a robust investment approach. Let me walk you through each one and explain why it matters for your financial success.

1. The Power of Multiple Models

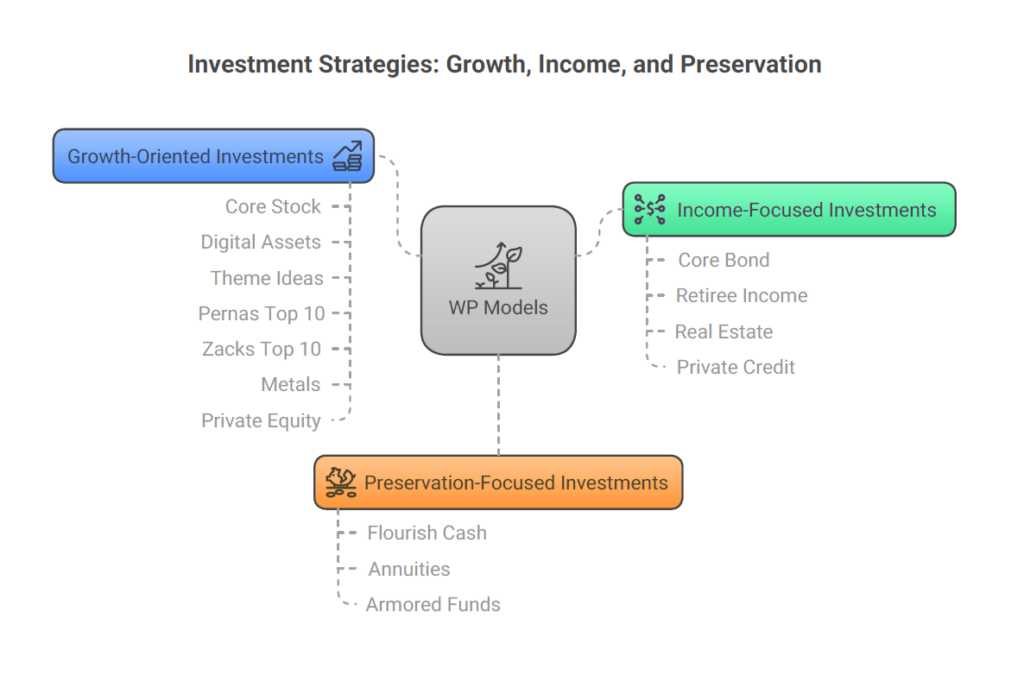

Imagine having different tools in your toolbox, each designed for a specific purpose. That’s how our multi-model approach works. We’ve developed 15 distinct investment models, each serving a unique purpose in your overall strategy. Some focus on passive investing, tracking major market indices efficiently, while others pursue specific ideas such as thematic ideas or alternative investing. Think of these models as different ingredients that, when combined thoughtfully, create a more complete and satisfying meal.

2. Understanding Diversification

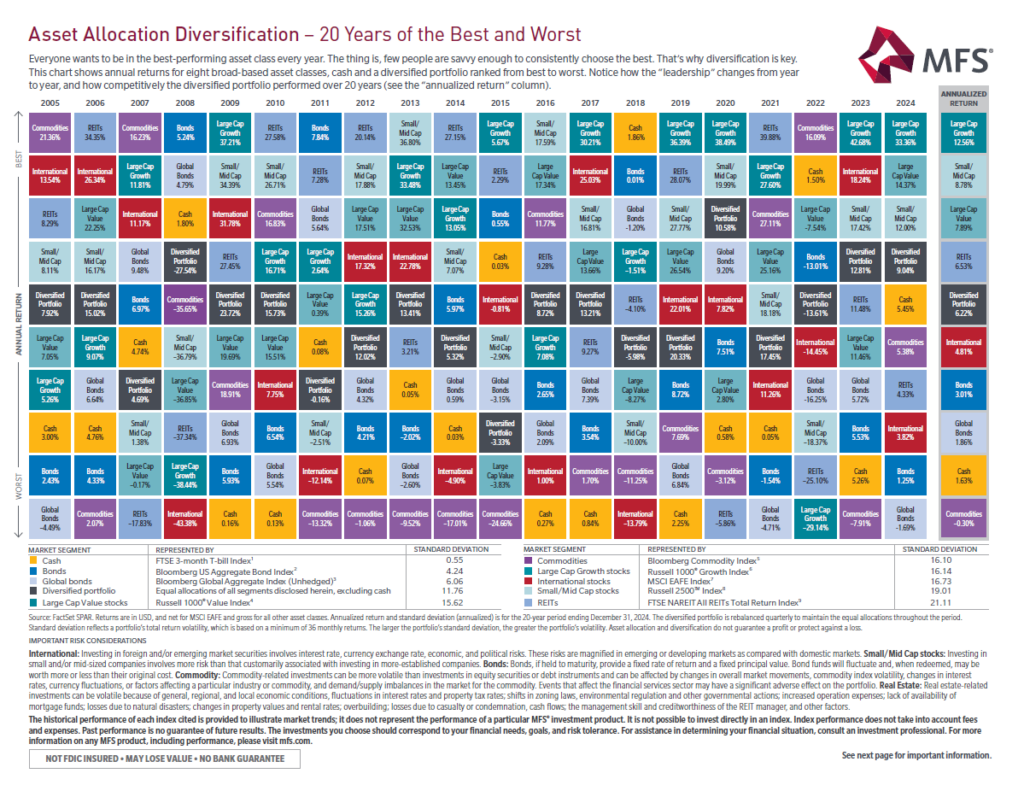

Diversification is your portfolio’s safety net. Consider how farmers plant different crops to protect against the failure of any single harvest. We apply the same wisdom when investing by spreading investments across various assets. When one investment faces challenges, others may flourish, helping to protect your overall wealth. This approach transforms the old warning about “not putting all your eggs in one basket” into a sophisticated strategy for preserving and growing your wealth.

3. The Art of Asset Allocation

Asset allocation is like conducting an orchestra – each instrument (stocks, bonds, cash, and alternatives) plays its part, but the magic lies in how they work together. Your personal financial goals, risk tolerance, and time horizon help us determine the perfect balance. For instance, someone nearing retirement might want more bonds for stability, while a younger investor might prefer more stocks for growth potential.

4. Dollar Cost Averaging (The Rhythm of Regular Investing)

Dollar-cost averaging brings discipline to your investment strategy. Think of it as establishing a healthy financial habit, like regular exercise for your portfolio. By investing fixed amounts at regular intervals, you avoid the emotional pitfalls of trying to time the market. A prime example of dollar cost averaging is contributing a set percentage of each paycheck to a 401(k) retirement plan. By consistently investing over time, you buy more shares when prices are low and fewer when prices are high, effectively smoothing out market volatility while fostering disciplined investing habits. Here is a good read on dollar cost averaging.

5. The Importance of Rebalancing

Annual portfolio rebalancing is like maintaining a garden – occasionally, you need to trim back the overgrown areas and nurture the underperforming ones. Markets naturally cause your portfolio to drift from its target allocation over time. Through regular rebalancing, we ensure your investment mix stays aligned with your goals and risk tolerance. This disciplined approach helps prevent your portfolio from becoming too aggressive or too conservative as markets fluctuate. Here is a good read on rebalancing.

In conclusion, investment success rarely comes from a single decision but rather from a series of thoughtful choices maintained over time. Whether you prefer to manage some investments yourself or rely on professional guidance, understanding these five elements helps you make more informed decisions about your financial future. Remember, investing is not about pursuing the highest possible returns at any cost – it’s about building a sustainable strategy that helps you achieve your unique financial goals while letting you sleep soundly at night.

Dave’s Picks

Why Books Don’t Work by Andy Matuschak

Is College Still Worth It by Anthony Isola

ROSÉ & Bruno Mars – APT. (Official Music Video)

How to Use ChatGPT (2025)

The Most Insane Gender Reveals