“Money makes money. And the money that makes money makes more money.” – Benjamin Franklin

Dear First Mates,

Happy Holidays, everybody! As we close out 2020, I’d like this newsletter to be a back-to-basics sort of deal. The kind of newsletter you’d share with your children and their friends. Let’s start from the top. There are six ways to attain wealth (if I’m missing any, lemme know).

1) Steal it

This is immoral (and illegal) but ultimately backfires because stealing deprives you of the joy of earning wealth. Don’t do this!

2) Win It

Gambling and playing lotto may be fun, but they are definitely not a wise way to build wealth. Save that AC/Vegas trip when you need some entertainment. Oh…and set a budget that you’ll stick to!

3) Inherit It

You received the genetic royal flush. Woohoo! Now, you must focus on not losing it since wealth is commonly lost after three generations.

4) Marry Into It

Dating can be a disaster show. But at least you got paid for your time!

5) Build it with a business

This is one of the most rewarding ways to build wealth for those willing to take risks. With so many resources available on the internet today now is an amazing time to explore this option.

6) Save and invest over a lifetime

This is the way most people build wealth – by diligently budgeting, saving, and investing their money – over a lifetime. With enough discipline, anyone can become the millionaire next door.

“Dave, how can saving monthly make me a millionaire?” Elaborate, please!”

The answer is through compounding—the idea of exponential growth. Let me take you back to my college days, when I learned this topic. The professor explained that my money grows like a giant snowball—without my finger lifting. The interest earns interest, which in turn earns more interest. Needless to say, I was hooked! Skeptical? Read on.

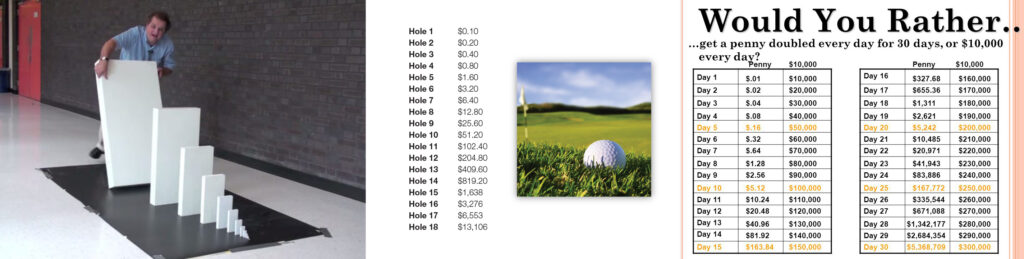

Example #1: Dominoes

Physics has shown that a domino can knock over another one that is 1.5 times taller. By the time you get to the 29th domino – it is as big as the Empire State Building. Check out this video, which beautifully illustrates this principle.

Example #2: Golf

Let’s say we played a game of golf with a friendly bet of 10 cents on the first hole, with the bet doubling on each successive hole. After a game of 18 holes, the final bet is worth a whopping $13,107.20. Check out this video to see the full math. Oh, and don’t make that bet unless you are REALLY good at golf!

Example 3: Would You Rather?

Would you rather receive $1 million today or the proceeds of one penny doubling over a month? Imagine my shock when I learned that the doubling penny is worth over $5 million after 30 days. Unbelievable, right? To see the math, click here.

This calculator is a great tool for visualizing the power of compounding in investing. You need to input a lump sum investment amount, a monthly savings amount, the annual rate of growth, and the timeframe for the $$$ to grow. And just like that, we are off to the races.

Illustration #1: You invest $5,000 as a lump sum while saving $100 monthly. The money grows at a rate of 5% per year for 10 years. Your ending balance is $23,827 (total deposits of $17,000 with earned interest of $6,827).

Illustration #2: You invest $25,000 as a lump sum while saving $250 monthly. The money grows at a rate of 7% per year for 20 years. Your ending balance is $231,959 (total deposits of $85,000 with earned interest of $146,959).

Illustration #3: You invest $50,000 as a lump sum while saving $500 monthly. The money grows at a rate of 9% per year for 30 years. Your ending balance is $1,658,765 (total deposits of $230,000 with earned interest of $1,428,765).

As you can see, time is truly your friend. So, the sooner you start, the sooner the compounding growth begins. The monthly savings can come in the form of a 401k paycheck deduction, a systematic monthly deposit to your brokerage account, or a lump sum check written when funds are available. This is why maintaining a personal budget is so important – to save for the future.

But where can you get 9% on your money? Banks are paying next to nothing, right? As shown here, the answer is by investing in equities (stocks) and fixed-income securities (bonds), which have historically grown at 10% and 5% per year.

On a personal note, I want to thank you all for sticking with me as I transitioned back to The WealthPlan LLC earlier this year. I am truly grateful and am excited to serve you in 2021. May your gifts be many and your returns be few. Have a spectacular holiday season!

Resources

My monthly newsletters

“Simple Wealth, Inevitable Wealth” (this book helped shape my investing philosophy)

Meb Faber series: The Get Rich Portfolio, The Stay Rich Portfolio, & How I Invest My Money

Dave’s Picks

Dirty Vegas – Days Go By (Official Video)

Largest Toppling Domino Stones World Record

How To Double Your Money In The Stock Market