“The stock market is the only market where things go on sale and all the customers run out of the store…” – Cullen Roche

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” – Peter Lynch

Dear First Mates,

And we’re back! Ok, so for this month, I’d like to focus on the difference between market risk, volatility, and drawdown. What do these words actually mean? And, practically speaking, how should investors use that knowledge? Time to set the record straight. I view this newsletter as a must-read that pairs nicely with my January 2021 newsletter. You can read our “First Principles” here. It is my belief that everyone can become wealthy (like this $8 million janitor), so let’s get crackin’!

Market risk is the possibility of an investor experiencing losses due to factors affecting the overall performance of the capital markets. Market or “systematic risk” cannot be eliminated through diversification. You’ve heard the expression, ‘A rising tide lifts all boats,’ but the opposite is also true. Sources of market risk include recessions, political turmoil, wars, natural disasters, and terrorist attacks. By contrast, unsystematic risk is the specific risk facing a company, industry, or country and can be reduced through diversification.

Volatility, or standard deviation, is a statistical measure of the dispersion of returns for a given security or portfolio of securities. What??? Said another way, volatility is the extent to which prices wander above and below their trendline. In essence, it tells you how intense the rollercoaster ride of investing will be. In most cases, the higher the volatility, the riskier the security. Volatility is symmetrical and does NOT ONLY refer to market declines. In fact, upside volatility is a welcome occurrence as it means your wealth is growing. Indeed, extreme “volatility” to the downside is an opportunity to profit from others’ mistakes.

The wonderful visual aid below illustrates how the S&P 500 has performed since 1926. The average return has been 10% per year, but in those 94 years, the S&P’s annual return fell between 8% and 12% in only six years! This means you rarely, if ever, see that average return figure on a yearly basis. Furthermore, market returns have been positive around 3 out of every 4 years. This is why I strongly advocate a buy-and-hold approach, as timing the markets has been a losing bet.

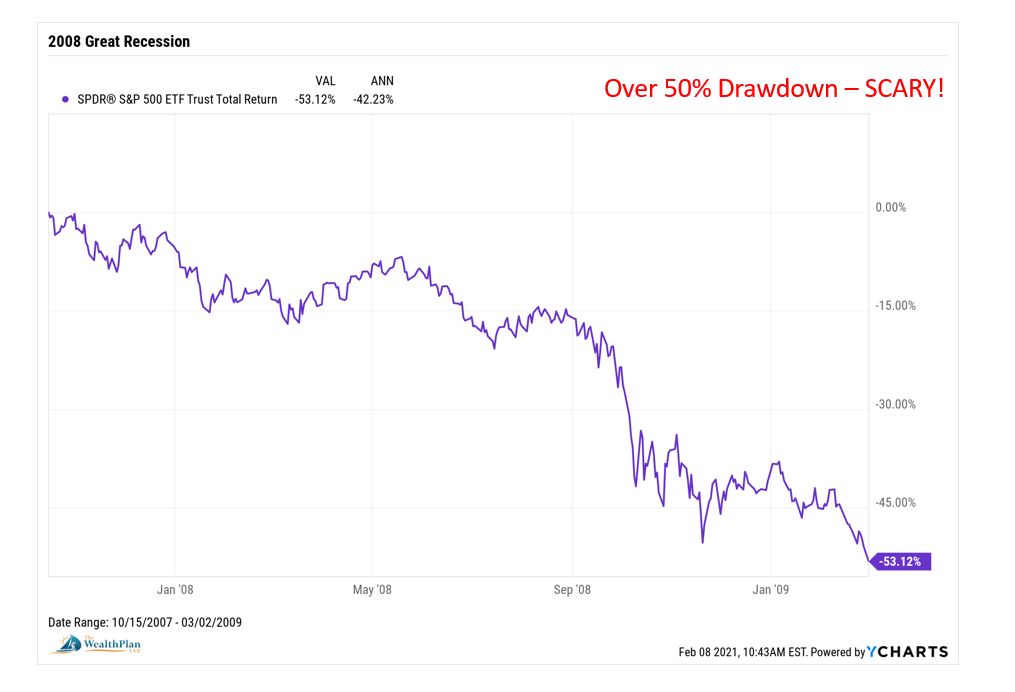

Drawdown refers to the largest drop in value from peak to trough before a new peak is attained. In essence, it measures the risk of loss over a specific time period. While drawdown measures the largest loss, it doesn’t account for the frequency of losses nor the size of any gains. I like this metric most because it’s simple, straightforward, and sets proper expectations. So – be prepared for a 50%+ drop once you become a stock market investor.

The next time the market crashes, ask yourself this one question. Does it seem probable to you that 500 of the largest, most seasoned, most well-financed, and most profitable companies in the world have permanently lost 20%+ of their value as ongoing businesses? Is it more likely that the distressed prices of their stocks are the tail temporarily wagging the dog? These drawdowns are literally a blip over your retirement. There is no wrong time to invest in mainstream equities. The S&P 500 came into 1980 at about 108 and went out of 2020 at 3,756.

Some takeaways:

- Volatility doesn’t mean the market is down greatly in an awful hurry. Volatility is neutral.

- Market returns can be great, terrible, or meh in any given year.

- In any given year, expect the market to drop about 14%*

- Investors should also expect the market to decline 20% or more every 5 years**

- You only lose money when you sell (paper losses are temporary and irrelevant)

- Hearing someone say there will likely be a correction this year is meaningless.

- Anything that reduces short-term volatility must also reduce long-term return.

In conclusion, volatility is the great friend of the long-term equity investor and should not be feared. For those accumulating shares, it’s actually a blessing. We will never succumb to mass emotion but rather work our plan. We shouldn’t be too shocked to learn that Fidelity found its best performers were the people who forgot they had an account there! Your largest drawdown is yet come. And now, you’re prepared for it.

Resources

*JP Morgan Guide to the Markets

**Nick Murray Newsletters: The Bear Market Chronicles, Updated Yet Again, December 2019

Dave’s Picks

My Cousin Vinny (3/5) Movie CLIP – Her Biological Clock (1992) HD

“Mad World” (feat. Gary Jules) – Official Music Video

Jessica’s “Daily Affirmation”