Financial Planning

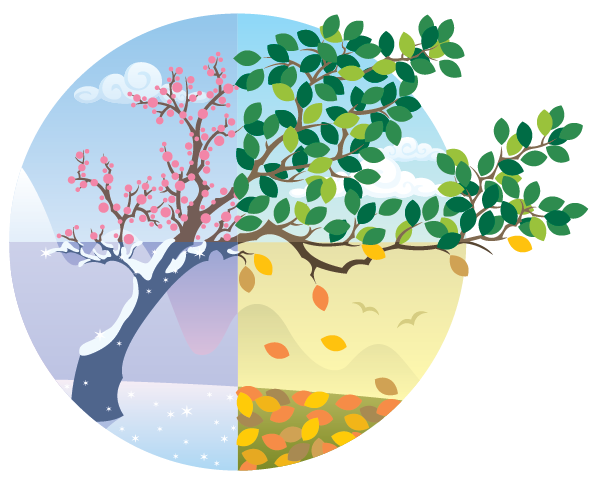

We Welcome You To Join The Four Seasons of Advice

At The WealthPlan LLC, we don’t believe in generic financial planning. We believe in seasons — because your life, your goals, your finances, and your needs evolve over time. Our Four Seasons of Financial Planning framework is built to move with you, adapting your financial strategy as your life transitions from one stage to the next. This is how we bring order, clarity, and momentum to your financial future.

Cash Flow & Retirement Planning (Winter)

Winter represents a season of transition and reflection—a time to prepare, simplify, and confidently enjoy what you’ve built. At The WealthPlan LLC, we guide you through this stage by helping you manage your retirement income and daily cash flow with precision. Whether you’re years away from retirement or already there, we help you understand where your money is coming from, where it’s going, and how to make it last. By combining thoughtful financial planning with powerful tools, we ensure your resources support your lifestyle, minimize risks, and give you peace of mind.

Topics We Cover During Winter:

- Your One Page Plan

- Saving for Major Goals

- Cash Flow Topics

- Social Security Benefits

- Aggregation Tools

- Unclaimed Funds

- What Does Retirement Look Like for You?

- How Much Do You Need to Retire?

Retirement isn’t just a milestone—it’s a new beginning. Let The WealthPlan help you build a financial plan that brings your future into a reality. Allow TheWealthPlan LLC to be your Financial Advisor in New York.

Tax Planning & Insurance Optimization (Spring)

Spring is a season of preparation and protection—the time to lay a strong foundation for the future. At The WealthPlan, that means being proactive with your tax planning and insurance. Smart tax planning helps you keep more of what you earn, year after year, while strategic insurance reviews protect everything you’ve worked hard to build. In this season of our Four Seasons Process, we focus on refining your financial strategy so that your plan can grow with clarity and confidence.

Topics We Cover During Spring:

- Making Your Tax Return Work for You

- Identify Where You Might Be Overpaying

- Clarify How Your Income is Taxed

- Explore Strategies to Lower Future Liabilities

- Insurance Optimization

- Life Insurance Review

- Disability Income Insurance Review

- Long-Term Care Insurance

- Property & Casualty Insurance Review

- Insurance Optimization

- Health Insurance

- Start Building a Stronger Foundation

Estate Planning & Assistance to Loved Ones (Summer)

In the estate planning phase, we guide you through key steps like wills, trusts, beneficiary designations, and guardianship planning. We also help minimize estate taxes with strategies to protect and preserve your wealth. From healthcare directives to powers of attorney, we ensure all documents are in place—and coordinate with your attorney and CPA to keep everything aligned. This module is also about providing thoughtful assistance to loved ones—whether it’s supporting aging parents, providing for children, or leaving a meaningful legacy to causes you care about, both during your lifetime and beyond.

Topics We Cover During Summer:

- Protect What You’ve Built. Provide for Who Matters.

- Why Is Estate Planning Important?

- Wills, Trusts, and Beneficiaries

- Utilizing trusts for asset transfers

- Coordinating With Your Attorney and CPA

- Minimizing Taxes on Your Estate

Investment & Account Reviews (Fall)

Wealth management managing effectively starts with understanding how everything fits together. From account access to portfolio performance and funding, we walk you through each piece so you can make informed decisions and stay on track with your financial plan. In the Fall season of our Four Seasons Process, we focus on execution—making sure your plan is active, aligned, and working toward your long-term financial goals.

Topics We Cover During Spring:

- Account Portal Review

- Alternative Investments

- Account Reviews

- Investment Performance Review

- Investment Strategy Breakdown

- Investment Funding Review

Book a Complimentary Discovery Session

Proactive financial planning isn’t a one-time event—it’s a year-round discipline. Ready to see if our Four Seasons of Planning model is a fit for your goals?

Click below to schedule your no-cost Discovery Session. Let’s make sure your strategy is working as hard as you are.