Dear First Mates,

Hello and Happy New Year! As we step into 2025, it’s a perfect time to revisit the foundational principles that guide our investment journey. These “First Principles” serve as the bedrock of our financial planning, ensuring that our strategies remain aligned with our deepest aspirations. Let’s delve into these guiding tenets:

1. Our Portfolio Serves Our Plan

Our investment portfolio is a tool designed to fulfill our financial plan, which is a reflection of our most cherished goals and dreams. It’s essential to remember that the portfolio is adaptable; it should evolve as our objectives change. In essence, a product is not a portfolio, and a portfolio isn’t a plan.

2. Systems Over Goals

While setting goals is vital, having robust systems and processes is even more crucial. Goals provide direction, but systems drive progress. This year, we’ll focus on developing actionable plans to turn our aspirations into reality.

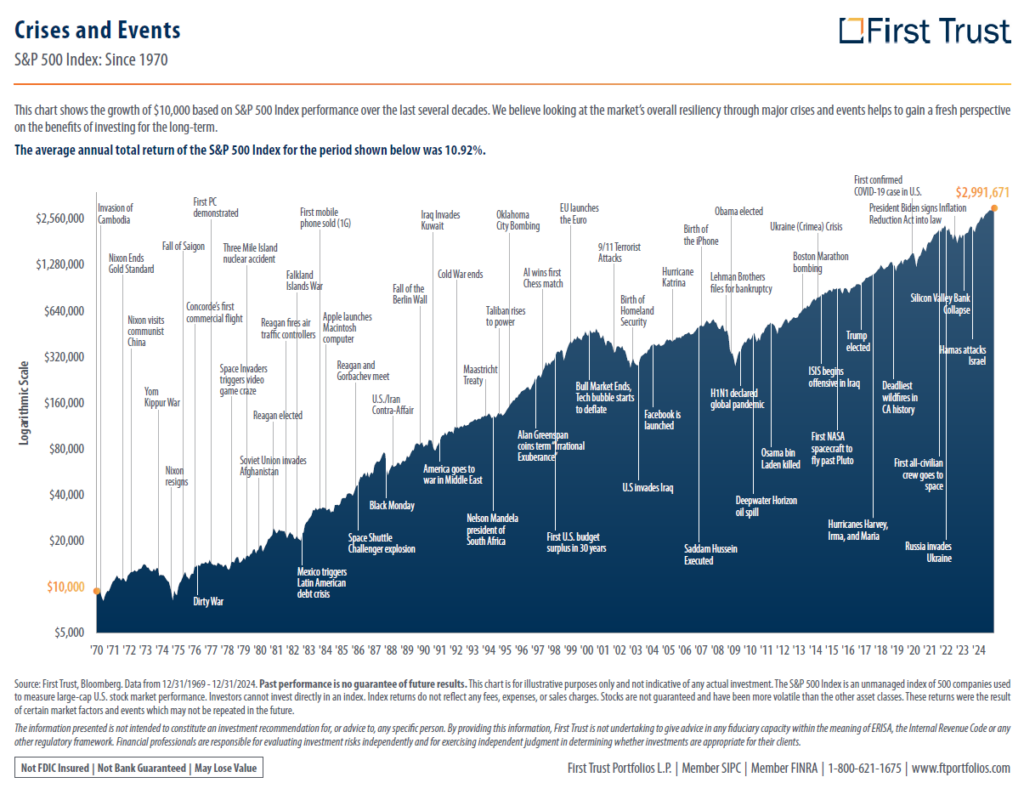

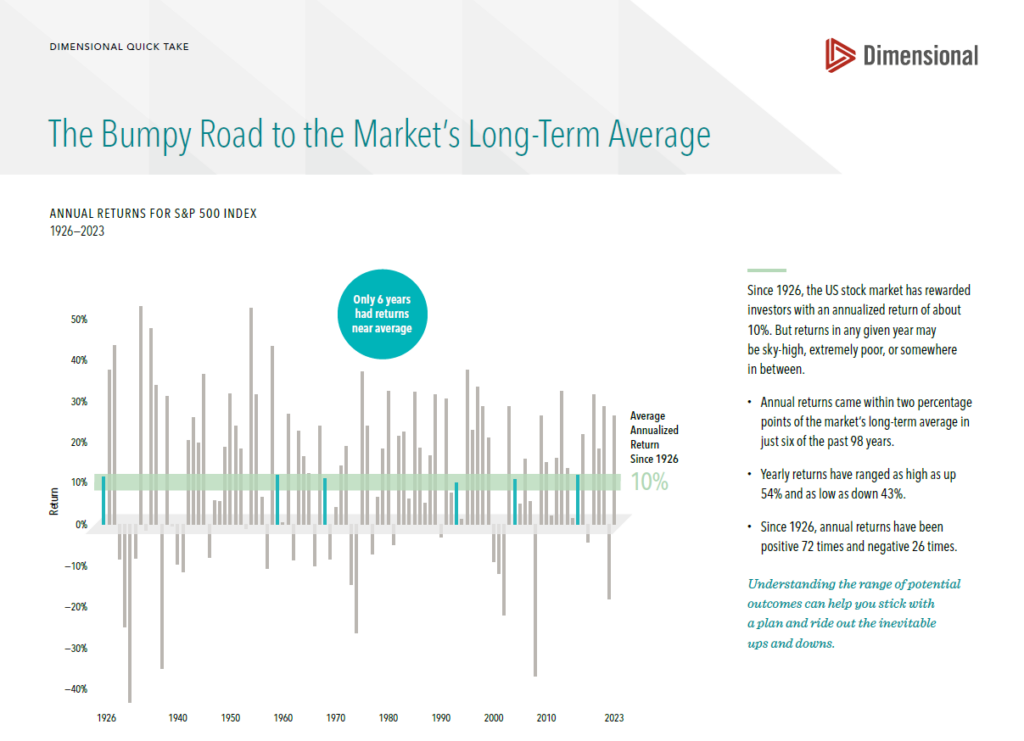

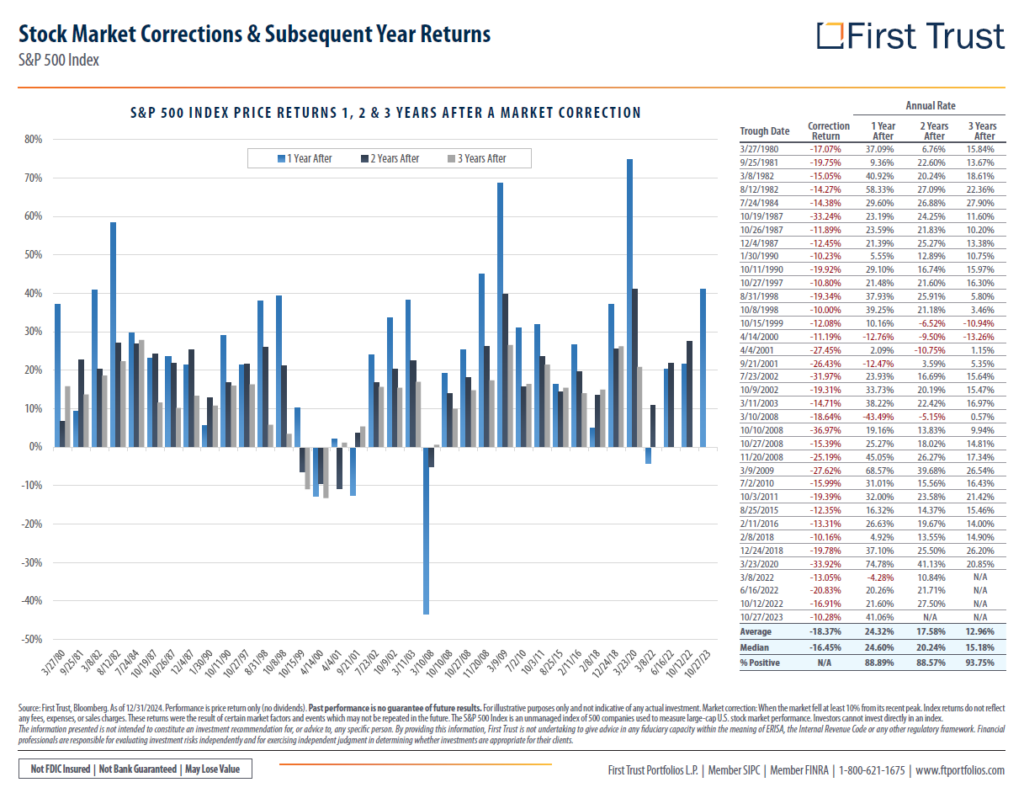

3. Embracing Optimism, Patience, and Discipline

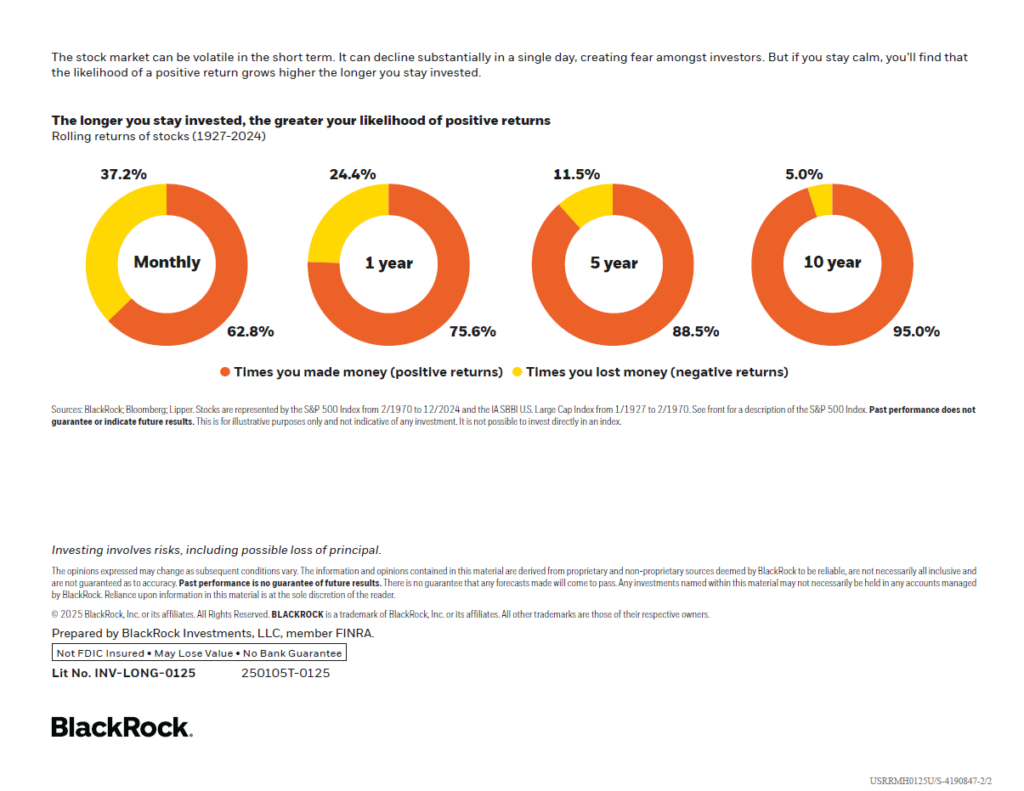

Building wealth that lasts requires us to outpace inflation and taxes through the power of compounding. Compounding is a remarkable force in personal finance, yet many underestimate its potential. By maintaining optimism, exercising patience, and practicing discipline, we can harness this power effectively.

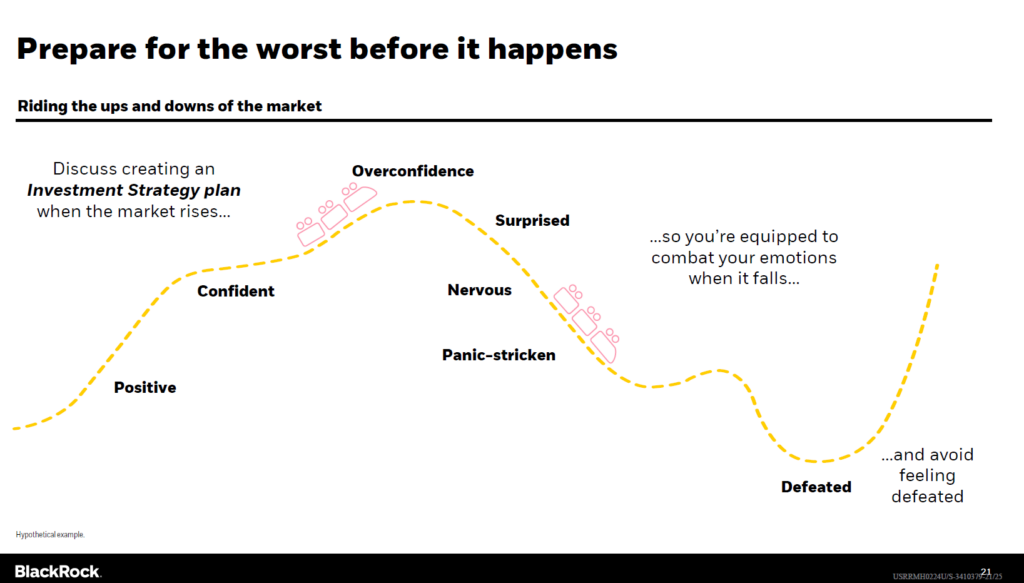

4. Avoiding Common Pitfalls

Ben Carlson highlights several common ways investors lose money in the markets. Key pitfalls to avoid include:

- Overestimating one’s ability to outsmart the market.

- Attempting to time the market consistently.

- Chasing after recent top-performing investments.

- Reacting to past events rather than current data.

- Taking investment advice from billionaires without considering personal circumstances.

- Prioritizing being right over making profitable decisions.

- Comparing one’s portfolio to the best-performing asset class.

- Blaming external factors like the Federal Reserve for underperformance.

- Focusing solely on short-term results.

- Selling all stocks during market downturns.

- Assuming one is the next Warren Buffett.

- Overreacting to market volatility.

- Maintaining a consistently pessimistic outlook.

- Treating investing as boring and turning to speculation.

- Trying to become rich overnight.

By steering clear of these behaviors, we can enhance our investment success. For a deeper dive into these pitfalls, you can read Ben Carlson’s article here.

5. Bridging the Gap Between Long-Term Intentions and Short-Term Actions

While we plan for the long term, it’s natural to be influenced by short-term events. To ensure our investments remain aligned with our long-term goals, we should:

- Automate contributions and investments.

- Maintain a disciplined asset allocation.

- Tune out short-term market noise.

Don’t fear change – embrace it.

6. Understanding True Risk

Traditional measures often equate risk with volatility. However, the real risk lies in the permanent loss of capital. It’s crucial to focus on preserving our investments and making informed decisions to mitigate this risk.

7. Knowing the Game We’re Playing

The investment landscape offers various paths, from real estate and venture capital to passive index investing and cryptocurrency. Each path has its own rules and dynamics. It’s important to identify the strategy that aligns with our goals and stick with it, avoiding distractions from other “games” that don’t suit our objectives.

In conclusion, investing is a challenging endeavor, but by adhering to these principles, we can navigate the complexities with confidence. In our next newsletter, we’ll explore practical steps to implement these ideas in 2025 and beyond.

Wishing you a prosperous and fulfilling year ahead!

Dave’s Picks

50 (Short) Rules For Life From The Stoics

How social media sabotages your brain’s Friendship Mechanism | Arthur Brooks

Intelligent vs. Smart by Morgan Housel

Lady Gaga, Bruno Mars – Die With A Smile (Official Music Video)

The secret to living longer may be your social life | Susan Pinker