Dear First Mates,

In today’s interconnected world, cybersecurity threats and identity theft are more prevalent than ever. In fact, Americans lost $10 billion to fraud in 2023 alone! I should know, as I almost became a victim of a brilliant social engineering scam myself. Watch this video to hear my story. Therefore, protecting your personal and financial information is crucial. This newsletter will explore the best tips and strategies to safeguard yourself against these digital dangers. Let’s dive in!

1. Stay Informed and Educated

Knowledge is your first line of defense. It is important to know the basic types of cyber attacks. A great list is available here.

2. Use Strong, Unique Passwords

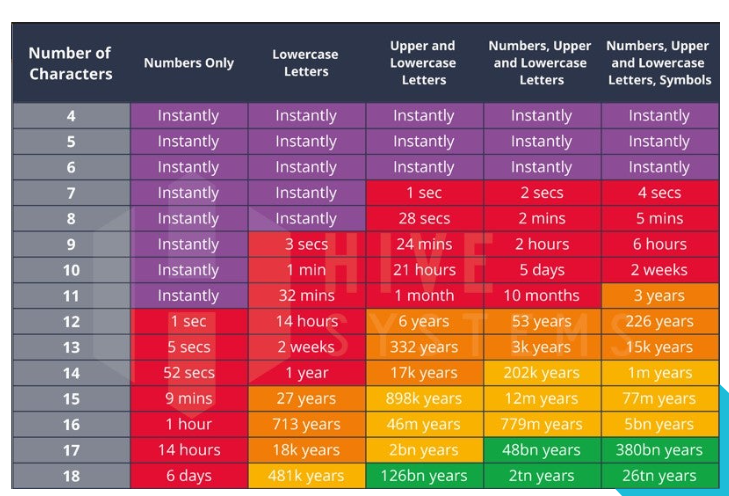

As you can see in the image below, it is quite easy to crack passwords.

A strong password is your first line of defense. Here’s how to create one:

- Length and Complexity: Use at least 12 characters, including numbers, symbols, and both uppercase and lowercase letters.

- Avoid Common Words: Don’t use easily guessable information like birthdays or pet names.

3. Use a Password Manager

A password manager is an excellent solution to implement today. It will save you time and money and is a much more secure system than keeping passwords on physical paper or your mobile phone. I use Keeper Security and could not be happier, but here are some others.

4. Enable Two-Factor Authentication (2FA)

2FA adds an extra layer of security by requiring a second form of verification. This can be a code sent to your phone or an authentication app such as Authy or Google Authenticator. Enable 2FA on all accounts that offer it, especially financial and email accounts. This is a must!

5. Secure Your Devices

Protect your devices from unauthorized access:

- Passwords and Biometrics: Use strong passwords, PINs, or biometric locks (fingerprint or facial recognition).

- Use Antivirus Software: You can find a good list of providers here.

- Encryption: Encrypt sensitive data on your devices.

- Regular Updates: Keep your operating system, antivirus software, and apps updated to protect against vulnerabilities.

6. Be Cautious with Public Wi-Fi

Public Wi-Fi networks are often unsecured. Avoid accessing sensitive information or conducting financial transactions over public Wi-Fi. Use a Virtual Private Network (VPN) to encrypt your connection if necessary. Here are some top VPN providers.

7. Monitor Your Accounts Regularly

Regularly check your financial accounts for any unusual activity. Early detection can prevent significant damage. Set up alerts for large transactions or changes to your account information. Using a budgeting tool like Monarch Money is great for this. You can also use monitoring services such as Carefull, Aura, & Lifelock.

8. Protect Your Personal Information

Be mindful of the information you share online. Limit the personal information you post on social media and other public platforms. Your business is no one’s but your own!

9. Regularly Review Your Credit Reports

Check your credit reports regularly for any signs of identity theft. You can get free reports annually from the three major credit bureaus: Equifax, Experian, and TransUnion. Look for unfamiliar accounts or inquiries.

10. Use Secure Payment Methods

Use secure payment methods like credit cards or payment services that offer fraud protection for online transactions. Avoid using debit cards for online purchases because your bank account is directly linked. A fraudster could quickly drain your bank account with fraudulent purchases before you even realize your debit card number has been compromised.

11. Have a Response Plan

In case of a cybersecurity breach or identity theft, having a response plan is crucial. This should include steps to take immediately, such as:

- Contacting Financial Institutions: Report any suspicious activity.

- Freezing Accounts: Temporarily freeze your accounts to prevent further unauthorized transactions.

- Reporting to Authorities: File a report with the Federal Trade Commission (FTC) and your local police department.

- Hire a Professional: Using a local IT professional or a service such as Geek Squad or HelloTech is wise.

Dave’s Picks

Peter Gabriel – Big Time

40 Harsh Truths I Know at 40 but Wish I Knew at 20

The 4 Types of Leverage to Supercharge Your Income by Nick Maggiulli

The Five Types of Wealth by ATMAN

Ong Bak (2003) trailer