“In essence, the fundamental benefits of investing into Ethereum is the cryptographic nature, it’s anonymity, it’s universality, it’s divisibility, and most specifically, it’s coding language which specifically targets it for automated transactions and contracts.” – Jeff Reed

Dear First Mates,

Welcome to Part II of my cryptocurrency series! This part focuses on the 2nd largest cryptocurrency (crypto): Ethereum. While blockchain technology is the foundation for Bitcoin, it has evolved far beyond that. The Ethereum blockchain, and others like it, offer many revolutionary features such as: smart contracts, decentralized applications (DApps), DeFi, non-fungible tokens (NFTs), and asset tokenization. So let’s dive right in!

Ethereum

Ethereum, created by Vitalik Buterin in 2015, is an open source, decentralized computing infrastructure for building and executing smart contracts and DApps. To simplify, Ethereum is the world’s first operating system (similar to Windows or Mac) on the world’s super-computer. This system enables developers to build powerful tools and applications (similar to email or a web browser). The ability for developers to create tools on the system further expands crypto’s potential. All of the benefits of blockchain can be seen in the Ethereum network. As I write, Ethereum has a market cap of around $300 billion.

Smart Contracts

What exactly is a smart contract? It is self-executing digital agreement where the terms between buyer and seller are written directly in the blockchain code. It’s best to think of them is an “If-then statement.” IF condition A exists, THEN perform function B. With smart contracts, agreements can be carried out among anonymous parties without the need for a central authority, legal system, or other external enforcement mechanism. The only trust needed is the trust in the code, which is heavily related to mathematics.

You may be more familiar with smart contracts than you think; using a soda vending machine is also an example of a smart contract. You put in money, push some buttons, and your refreshing beverage is delivered. The transaction was done in seconds via the vending machine protocol. Now, imagine doing that for title insurance, getting a mortgage, or trading stocks! This is what Ethereum has set out to do – and is doing it! Of course, anything involving computer code faces cybersecurity risk. Remember the DAO?

DApps

Decentralized applications are digital applications or programs that exist and run on a blockchain network. These applications are similar to applications found on your phone and computer, but they run on the blockchain without the control of a single authority (i.e. individual, company, or government). The Brave web browser, with almost 9 million active users, is a popular DApp some of you may actually be using. DApp’s strengths include being censorship-resistant, no downtime, and open source. DApp weaknesses include the potential for hacks, poor user interfaces, and heavy reliance on a large network. Many of the DApps in existence today are part of another budding ecosystem, known collectively as DeFi.

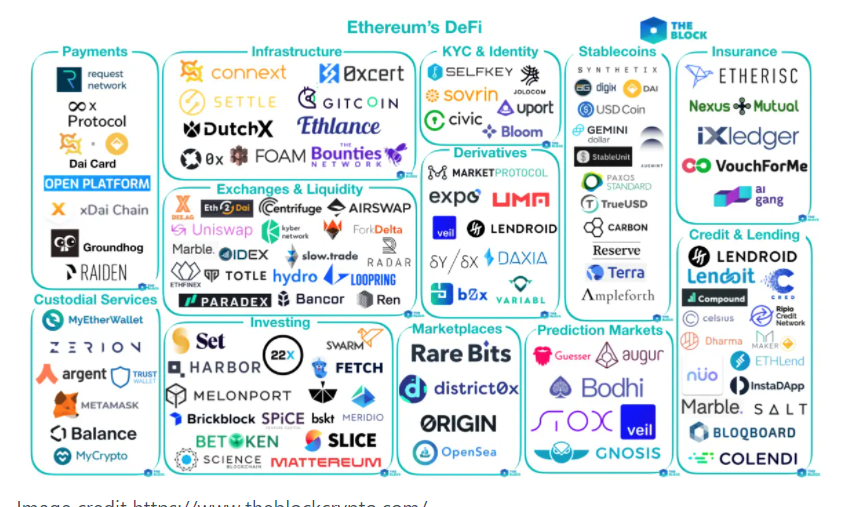

DeFi

The DeFi ecosystem now represents an expansive network of integrated protocols and financial instruments worth more than $53 billion. DeFi (or “decentralized finance”) is an umbrella term for financial services offered on public blockchains. Common services offered by traditional banks are now available through DApps on the Ethereum blockchain. DeFi started rising in popularity in 2019 and made an even larger climb during the summer of 2020. While not without risks, the possibilities with DeFi are truly exciting,

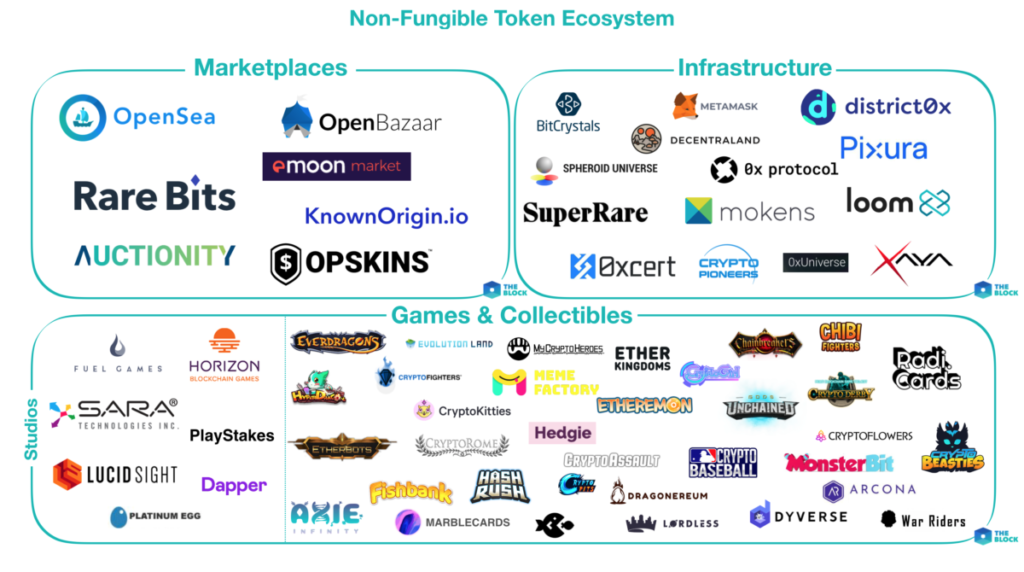

NFT’s

Non-fungible tokens are digital assets on the blockchain that cannot be traded, replicated, or exchanged at equivalency. This differs from fungible monies (like fiat currencies and cryptocurrency), where one unit is interchangeable with another unit to enable commerce. NFT’s exhibit three distinct characteristics:

1) Non-fungibility: Each NFT is not interchangable with another NFT.

2) Rarity: The scarcity of each NFT is what makes them desirable

3) Indivisibility: NFT’s must be bought, sold, and held as a whole unit.

Large NFT transactions making waves recently include:

1) Jack Dorsey, Twitter founder and CEO, sold his first tweet for $2.9 million

2) An artist known as Beeple sold a piece of artwork for $69.3 million

3) An NBA Top Shot video highlight featuring LeBron James sold for $208,000.

NFTs are largely used in industries such as video games, sports cards, artwork, collectibles, and even people’s identities. Considering that videogames are currently a bigger industry than movies and North American sports combined, one can appreciate the potential NFT’s possess to disrupt many industries. But what if we could tokenize mainstream assets? Enter asset tokenization.

Asset Tokenization

Asset tokenization is how any real-world asset, tangible or intangible, becomes digitized, and then broken down into smaller parts which take the form of tokens. Imagine a world where we can tokenize mainstream assets like stocks, bonds, real estate, commodities, information, usage rights, and even government-issued currencies! Benefits of tokenizing assets include all blockchain benefits as well as increased liquidity, reduced costs, and investment democratization. I believe new business and social models will emerge in the future as a result of asset tokenization.

To summarize, the Ethereum cryptocurrency is a truly revolutionary blockchain technology that has the potential to disrupt many industries through its real world utility. I am extremely bullish on Ethereum – but even moreso on the entire DeFi space. It should come as no surprise that Ethereum has much competition from cryptos like Binance Smart Chain, Polkadot, Cardano, Terra, and Solana. In Part III, I will focus on implementing crypto in your portfolio.

P.S. Some popular Youtubers in the crypto sphere are Andrei Jikh, Graham Stephan, Anthony Pompliano, Ivan on Tech, Coin Bureau, Lark Davis, and Boxmining. Andrei & Graham also have excellent videos on personal finance in general.

Resources

What is Ethereum?

Ethereum Vs. Bitcoin: What Sets Them Apart? | CNBC

What is Asset Tokenization?

Top 12 Smart Contract Use Cases

The tokenization of things | Matthew Roszak | TEDxSanFrancisco

What is an NFT? (Crypto Beginners)

Dave’s Picks

Yuval Harari – Sapiens: A Brief History of Humankind

Is Bitcoin the Future of Money? Peter Schiff vs. Erik Voorhees

Cyndi Lauper – Time After Time (from Live…At Last)