Hey First Mates,

As a financial advisor, my top priority is protecting clients from bad investments and behaviors. However, sometimes, this mission can be taken too far, potentially hurting wealth creation. In this newsletter, we argue FOR speculation when done wisely.

What is Speculation?

Speculation is like the Wild West of investing—high risk, high reward. If you hit the jackpot, you could make a ton of money. But if you miss, your investment could sit there and idle or even vanish. Think cryptocurrencies, small-cap stocks, privately held businesses, and collectibles – to name but a few. Speculation can also be where the majority of one’s wealth is concentrated in one or just a handful of stocks.

Conventional wisdom says to never put more than 2% of your net worth into one investment. But tell that to Bill Gates, Elon Musk, or Jeff Bezos. These icons had most of their wealth tied up in their companies. With great risk comes the potential for great reward.

When is it Wise to Speculate?

Speculation can be acceptable, even wise, if it meets these three criteria:

- Less than 20% of your overall net worth: Keep your speculative investments within this limit.

- Achieve your goals even if they falter: Make sure you can still reach your financial goals if the investment fails.

- Temperament to hold long-term: You need patience to ride out the ups and downs.

The Amazon Rollercoaster

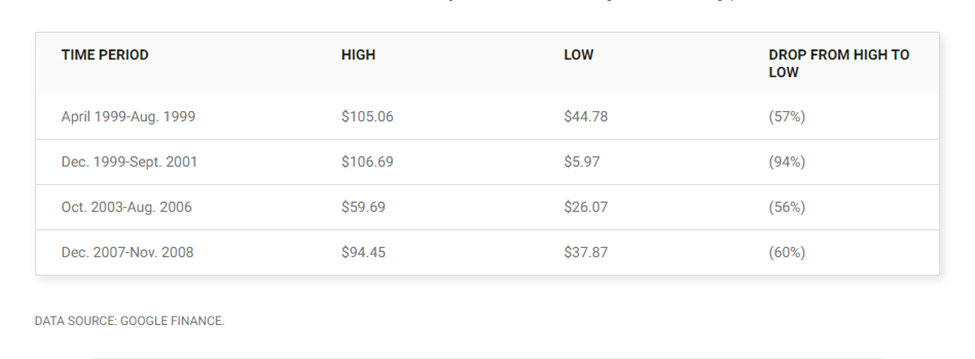

Imagine I gave you a time machine to buy Amazon stock when it went public on May 15, 1997. Would you have held onto it through its rollercoaster ride to becoming one of the biggest companies in the U.S.? Let’s see…

Odds are, you’d have struggled to hold onto Amazon stock and sold along the way. It dropped over 50% four times, and one of those drops was a jaw-dropping 94%! Who has the patience and discipline to hold through that? Investing is super hard.

What is Loss Aversion and Is It Always True?

Loss aversion is a cognitive bias that explains why individuals feel the pain of loss twice as intensively as the equivalent pleasure of gain. As a result, individuals tend to try to avoid losses in whatever way possible. We can all relate, right?

But what if that’s not the whole story? For many, the pain of missing out on a mega winner might hurt more than losing the entire investment. Ask yourself which scenario would hurt more:

- Scenario A: You invest $50,00 and it goes to $0.

- Scenario B: That $50,000 turns into $500,000, but you missed out.

Everyone will answer this differently, and hindsight bias is real. Many might say that missing out on $500,000 hurts more than losing the initial $50,000.

In Summary

There’s nothing wrong with taking big bets on speculative investments. Just do it smartly and know thyself. Happy investing!

Dave’s Picks

How to Invest Like the 1% by Ben Carlson

How to Get Rich in the Markets by Barry Ritholtz

The Divorce Expert: 86% Of People Who Divorce Remarry!

Duke Dumont – Ocean Drive (Official Music Video)

The Orgasm Expert: THIS Is How Often You Should Be Having Sex & Stop Inviting Pets Into The Bedroom!