Dear First Mates,

I hope you are all well and in good spirits. In light of this year’s bear market, I want to be a beacon of light with a call to action.

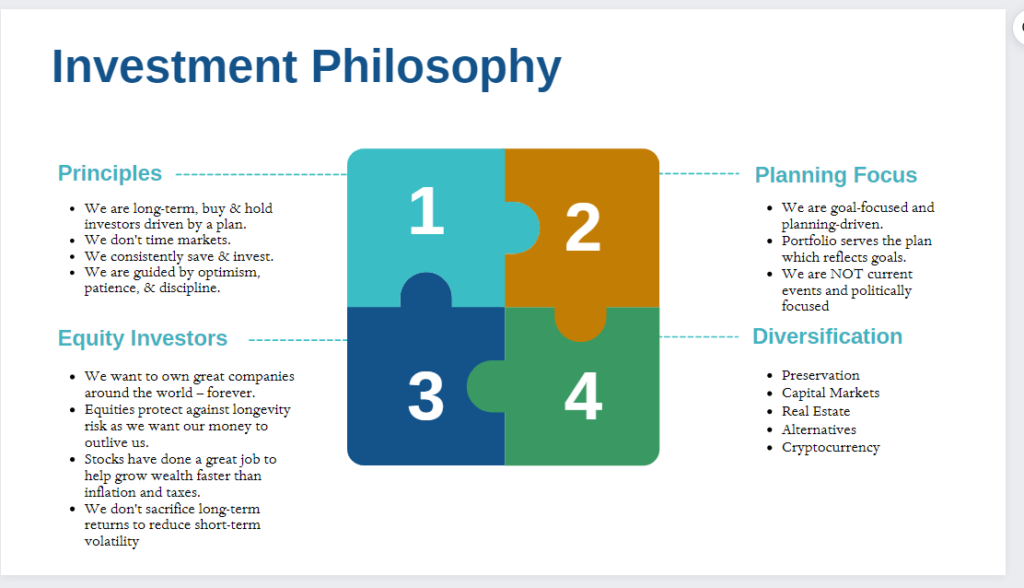

1) Study my investment philosophy below as this is our North Star.

2) Do nothing and stay the course. This, too, shall pass.

3) If you are sitting on excess cash, consider investing immediately to buy the dip.

4) Revamp your financial plan with me.

5) Read Nick Murray’s perspective down below.

I’m always here to talk this through with you. Thank you for being my clients. It is a privilege to serve you.

Nick Murray’s Perspective

“The primary function of financial journalism seems to be terrifying us out of ever achieving our financial goals by shrieking about the market’s volatility. We’ve been reminded of this almost hourly as the S&P 500 approached “official bear market territory,” defined as closing 20% below its January all-time high.

Every market decline of this magnitude has its own unique precipitating causes. I think it’s fair to say that the current episode is a response to two issues: severe inflation and the extent to which the economy might be driven into recession by the Federal Reserve’s somewhat belated efforts to root that inflation out. (Russia’s war on Ukraine, supply chain issues, and the like are surely contributing to the angst, but recession vs. inflation is the main event, in my judgment.)

I look at it this way:

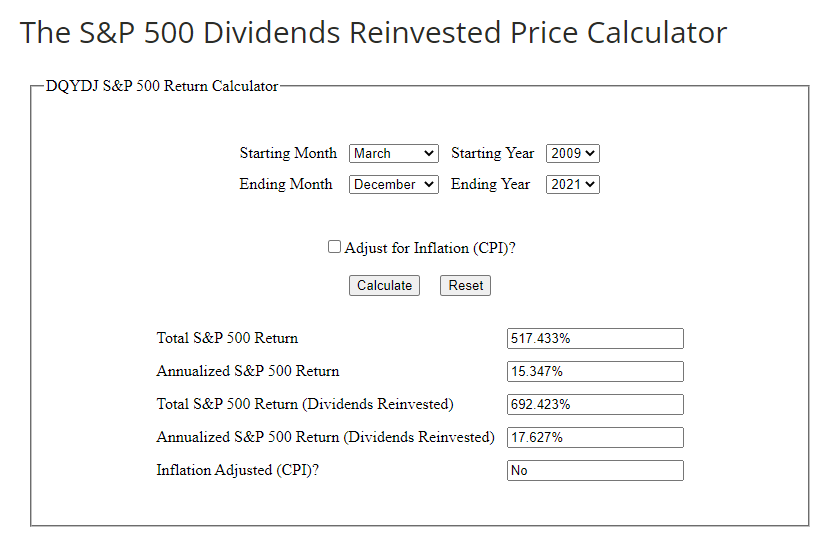

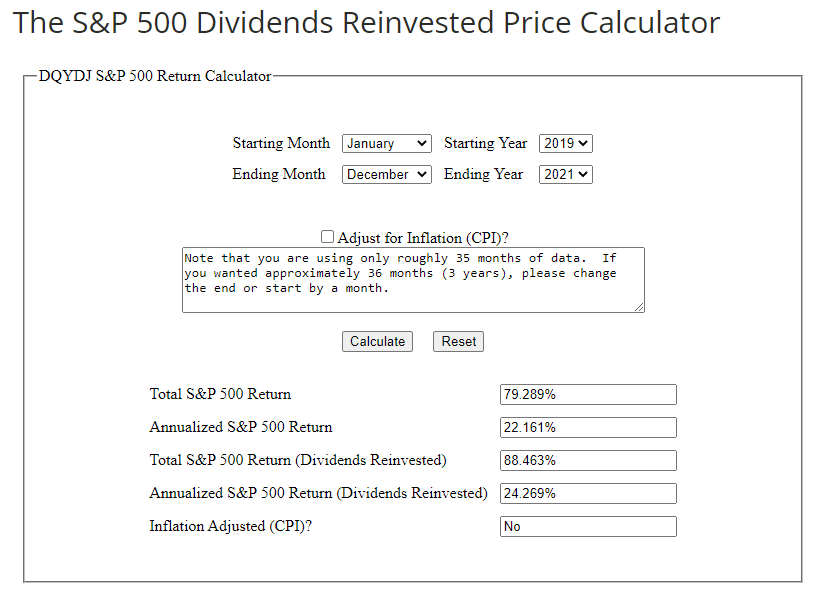

From March 2009 (when the equity market bottomed at the end of the Global Financial Crisis) through the end of 2021, the S&P 500 produced an average annual compound return of around 17.5%*. Indeed, over those last three calendar years (2019 – 2021), despite a hundred-year global health crisis that carried off millions of people worldwide, the Index compounded at around 24%* per year. This was one of the greatest runs of all time.

But it’s evident that some part of that extraordinary accretion in equity values was due to excessive monetary stimulation by the Fed. And to that extent, we are having to give some of that gain back, as the Fed moves to bring the resultant inflation under control. We should, I believe, want them to do this, even if it means the economy slows. In the long run, the cure (possible recession) is not more painful than the disease (inflation).

For long-term investors, capitulation to a bear market by fleeing equities has often proven to be a tragedy, from which their retirement plans may never recover. Our investment policy is founded on the acceptance of the idea that the only way to be reasonably assured of capturing equities’ premium returns is by riding out their occasional declines.

Your advisor’s mission: not to insulate you from short- to intermediate-term volatility, but to minimize your long-term regret – the regret that has always followed a fear-driven exit when equities resume their long-term advance. As they always have.

*P.S. You can demonstrate the compound returns above to yourself with DQYDJ’s S&P 500 Return Calculator. The underlying data are from the Nobel laureate Robert Shiller. This is the source of the return calculations mentioned above.”

Dave’s Picks

Golden Train – Justin Nozuka

‘The Sopranos’ Cast Reunites For 20th Anniversary: Full Interview | TODAY

What If You Pursued Contentment Rather Than Happiness?

Can money buy happiness?